Natwest - Business Banking Ecosystem

For this project I worked through an agency called Nimbletank. We had an internal team working on this project, but also had a very close relationship with the wider Natwest team. The project was to understand what SME’s are looking for within their business banking world to help develop their business - this could be anything from growth, getting set up, or hiring staff. Natwest offer a huge range of programmes, resources, mentors etc, but find that SME’s don’t know they exist, or don’t really want to engage.

We ran a 9 week project which went through several different phases to come up with a solution or recommendations for how Natwest could create an ecosystem, to offer all of the products/services that they currently have to SME’s in a smart and insightful way. But also to get an understanding in what was missing, what customers actually want and if something like this would even be of interest in the first place.

I was the UX Lead on this project.

01. Research & Discovery

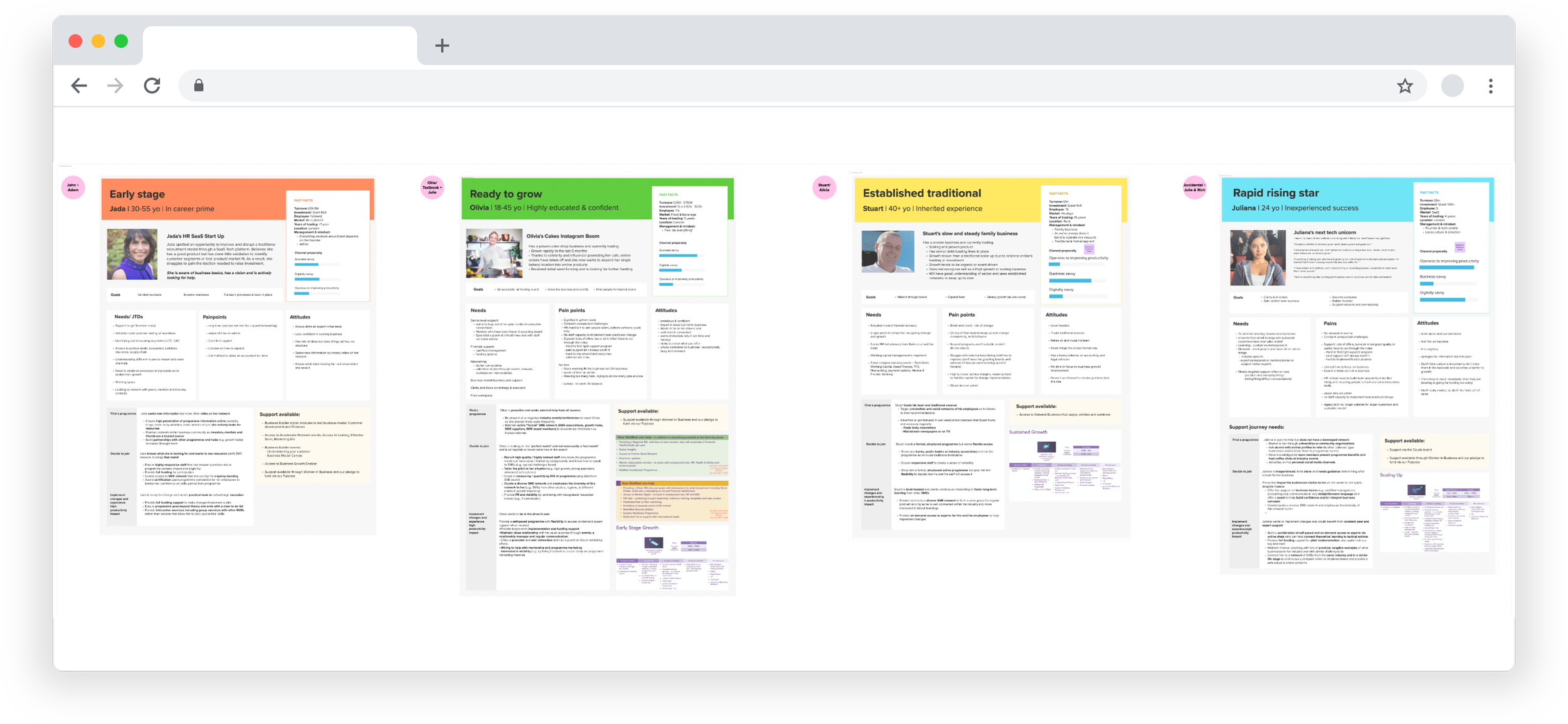

We started this project by going into a research and discovery phase. This phase began by us hosting several workshops with the client, to understand their current offerings/products, what their goals were for the project and why. These workshops included over 30 stakeholders from Natwest, which meant that after the workshops, we had a huge amount of information to audit and digest. There had also been several work streams that needed to feed into this project, as Natwest had somewhat already done some research and ideation on this.

The second part of this phase began with me leading a research safari. I looked at hundreds of examples inside and outside category, to get an understanding of who was doing it well and how they have achieved this. We had 4 different themes that I was specifically looking for within this research, which were based on our customer personas and all the information we had collected from the client: Human Support, Strategic Business Development, Running the Business and Personal Development.

Each example that we deemed to be a ‘best in class’ experience was then analysed and put into a deck to present back to the client stakeholders within our ideation session in the next phase of the project. Find the deck here.

02. Ideation

Once we had completed the research and discovery phase, we moved into ideation. We started this by again having a workshop with the client to present back all of our findings, in the hope that this would spark creativity. Thankfully it did, and during the workshop over 100 ideas were created by the stakeholders. We were really pleased with the outcome of this session, and felt like the research that we had done had helped the stakeholders think outside of the box, and start to push the boundaries a little with what potentially could be achieved.

Once we had all of these ideas on a mural board, internal sessions were held to prioritise which ideas were going to be taken forward into quant/qual testing. We had meetings with certain stakeholders to help decide the level of priority and also what realistically could be achieved in the small time frame that we had. When all of the ideas had been prioritised, I then had the job of turning these high level ideas into tangible concepts that we could split between quant testing and qual testing.

03. Quantitive Testing

For quantitive testing we worked with a company called ImpactSense, who facilitated this round of testing for us. The plan was for them to gain feedback from 800 SME’s over a 10 day period. This testing would be a survey where users would answer some background questions, watch some UX prototype videos of small journeys and then rate them on a sliding scale of usefulness, and also view some designed screen mockups and complete a card sort exercise with these screens.

To get to that point I took all of the concepts that I had created, and turned them into low-fed wireframes. I worked very closely with the Natwest design team as I wanted to ensure that the designs I created were consistent with the Natwest brand, but also not limiting the work that we were doing. Once the screens had been signed off by the stakeholders and the Head of Design at Natwest, I then turned the wireframes into prototypes, and videos with voice over.

04. Qualitative Testing

Whilst all of the concepts for the SME ecosystem were in quant testing, we then started to plan and undertake the design work for the qual testing. Here we wanted to find out how the products that Natwest already had, as well as some of the concepts we had proposed in the previous round of testing would be delivered to the customers in a smart and insightful way. We knew from our previous research that just giving customers access to a huge platform with the entire offering wasn’t the right thing to do. This led to customers feeling overwhelmed and not necessarily knowing where to go.

I then worked closely with the Natwest stakeholders and our internal team to understand the prioritised products, and also gain an understanding of the current SME bank account. This then allowed us to create concepts where we could deliver these products to users in an insightful way. We tested with 10 participants, over the space of three days. For each participant I created a different prototype that was specific to them and their business needs - Each user saw the same concepts, it was only the content the differed. We had 7 different concepts that were tested, some of these examples can be found below: Location specific events, personalised mentor recommendations, expert guides and 1-2-1 expert chats.

05. What we found out

Personalisation and Relevance

Users are more likely to engage with the proposition if it felt relevant to what their business needs were at that point in time.

They had an expectation that this information would be known by Natwest (aka based on turnover and banking information)

Propositions that are not only suited to one specific business type, size, persona etc, but are also delivered to the right customer type at the right time means they’re more likely to engage.

Communication and Transparency

Communicating the benefit of the proposition upfront

Messaging about free, no obligation etc, was well received so we should always indicate when that is the case

Mention if/how the proposition is affiliated to Natwest, so that users always have an understanding of this

Decision making and Time Poverty

Ensuring there is enough information for users to want to learn more

Communicating timings upfront is key. SME’s are often very busy, so them not having an understanding of how long they will have to dedicate to something usually means that they will decide not to do so.

Creating resources that are flexible and vary in time frame means that we aren’t excluding users that simply want to listen to a 5 minute podcast, or prefer a more dedicated and lengthy course.

Users going into their bank account is usually with a task in mind. This means that they could be more likely to dismiss popups/insights if they don’t feel relevant or aren’t delivered in a timely manner.

Giving users the option to save content for later, or download to their device enables them to revisit content in a timeframe that suits them better.